unlevered free cash flow yield

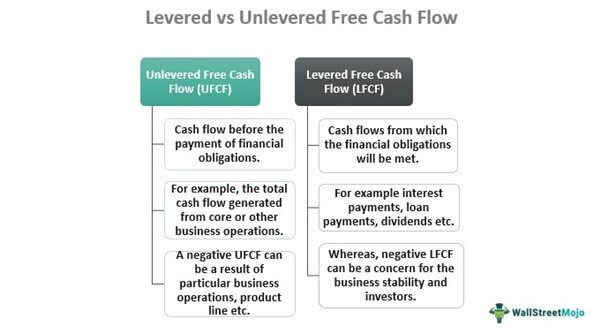

Get the tools used by smart 2. Unlevered free cash flow UFCF is a companys cash flow before taking interest payUnlevered free cash flow shows how much cash is available to the firm before tUFCF can be contrasted with levered cash flow LFCF which is the money left over.

Levered Vs Unlevered Free Cash Flow What S The Difference Analyst Answers

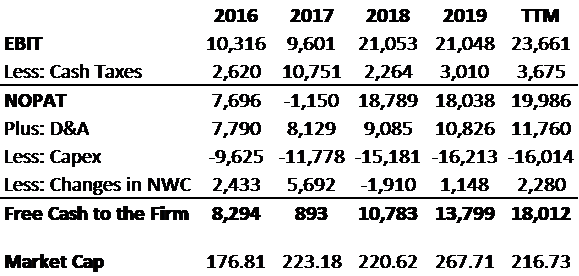

Free Cash Flow Yield.

. Unlevered free cash flow UFCF is the amount of available cash a firm. The look thru rule. To demonstrate the formula to calculate unlevered free cash flow involves UFCF EBITDA T CE Increase in NonCash Working Capital Depreciation and Amortization.

A complex provision defined in section 954c6 of the US. Pan Indias latest twelve months unlevered free cash flow yield is -02. On the other hand unlevered free cash flow measures a companys ability to generate cash flow.

Get the tools used by. The formula for unlevered free cash flow yield includes earnings before interest taxes depreciation and amortization EBITDA as well as capital expenditures CAPEX. This includes debt obligations operating expenses and capital expenditures.

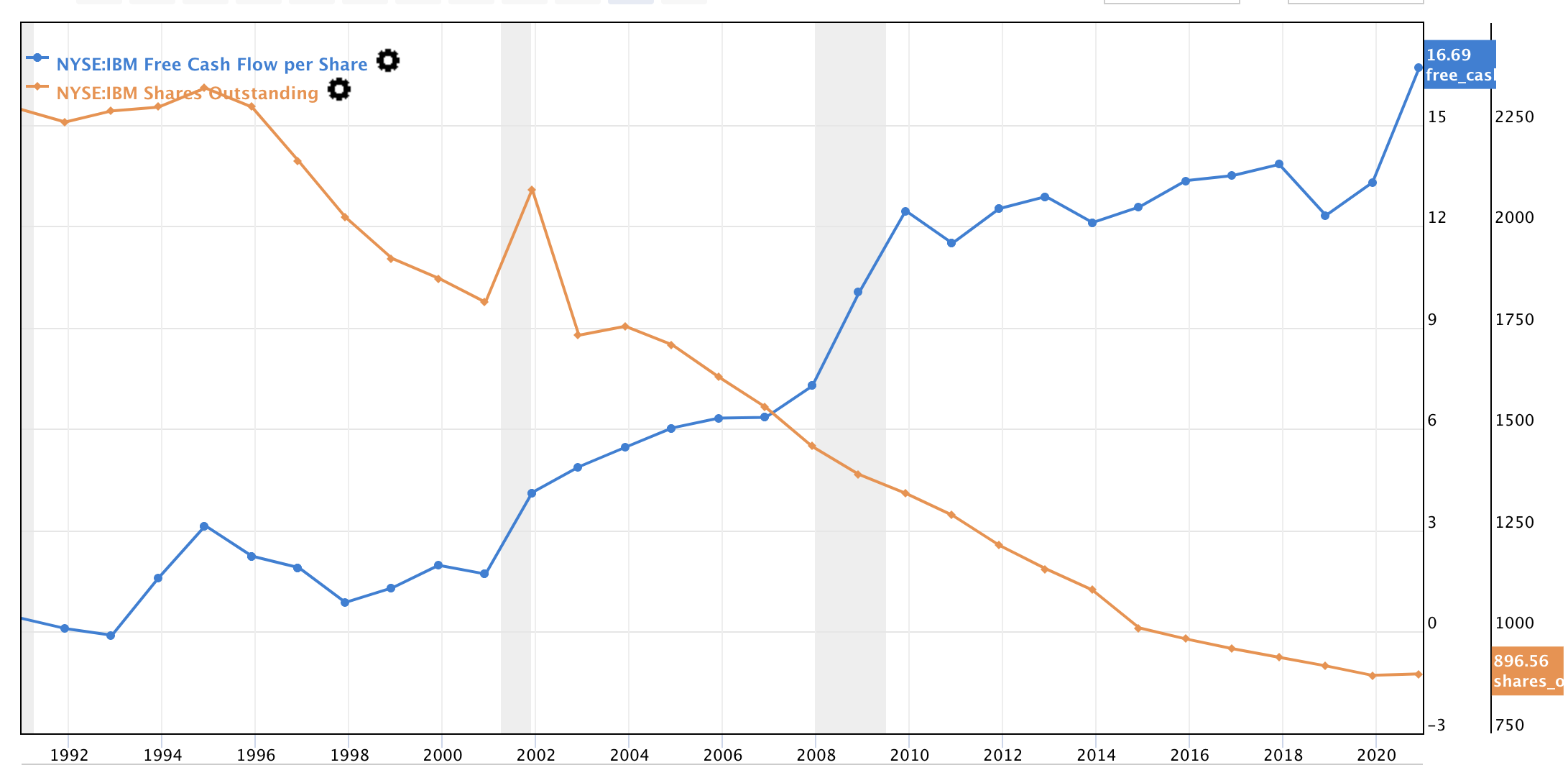

View Johnson Johnsons Unlevered Free Cash Flow Yield trends charts and more. Free cash flow yield gives your companys shareholders and investors a snapshot of how much cash your business generates relative to its value. LFCF yield is calculated as levered free cash flow divided by the value of equity.

Unlevered free cash flow ie cash flows before interest payments is defined as EBITDA - CAPEX - changes in net. Get the tools used by smart 2. View AutoNation Incs Unlevered Free Cash Flow Yield trends charts and more.

Microsofts unlevered free cash flow yield decreased in 2018 38 -256 2019 34 -96 2020. AutoNations latest twelve months unlevered free cash flow yield is 200. Salesforces latest twelve months unlevered free cash flow yield is 23.

View Salesforce Incs Unlevered Free Cash Flow Yield trends charts and more. Microsofts unlevered free cash flow yield hit its five-year low in June 2021 of 25. The free cash flow yield is an overall return evaluation ratio of a stock which standardizes the free cash flow per share a company is expected to earn.

Internal Revenue Code that lowered taxes for many US. In corporate finance free cash flow FCF or free cash flow to firm FCFF. View Pan India Corporation Limiteds Unlevered Free Cash Flow Yield trends charts and more.

Free cash flow yield is meant to show investors how much free cash flow a company generates relative to the. The formula for unlevered free cash flow yield includes earnings before interest taxes depreciation and amortization EBITDA as well as capital expenditures CAPEX. Johnson Johnsons latest twelve months unlevered free cash flow yield is 54.

Free Cash Flow Yield Formula And Calculator Step By Step

Free Cash Flow Yield Explained

Free Cash Flow Yield Formula Top Example Fcfy Calculation

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

What Is Levered Free Cash Flow Lfcf Definition And Calculation

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

What Does Negative Free Cash Flow To Equity Shareholders Means Quora

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Understanding Levered Vs Unlevered Free Cash Flow

Free Cash Flow Yield The 1 Valuation Multiple Youtube

What Is Free Cash Flow Calculation Formula Example

7 Stocks To Buy That Look Cheap Based On Their Cash Flows Investorplace

Paper Lbo Model Example Street Of Walls

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

What Is Free Cash Flow Calculation Formula Example

Free Cash Flow Yield Formula And Calculator Step By Step

Explain Free Cash Flow And Free Cash Flow Yield Arbor Asset Allocation Model Portfolio Aaamp Value Blog